In a larger corporation, these factors can result in substantial ongoing changes in the number of shares outstanding, making it more difficult to calculate the weighted average of shares outstanding. The weighted average of outstanding shares is a calculation that incorporates any changes in the number of a company’s outstanding shares over a reporting period. The reporting period usually coincides with a company’s quarterly or annual reports.

Weighted Average Cost Per Share

The number of outstanding shares changes if the company issues new shares, repurchases existing shares, or if employee options are converted into shares. If a company issues stock dividend or exercises a stock split after the end of its reporting period but before the issuance tax benefits for having dependents of financial statements to stakeholders, it must restate its common shares for the whole year. Similarly, if it uses the financial statements of one or more proir periods for comparison purpose, the shares for those periods must also be restated in the same way.

Do you already work with a financial advisor?

If a company considers its stock to be undervalued, it has the option to institute a repurchase program. Weighted average shares outstanding is the process of weighting every number of common stock to reflect how much time they were in effect. Companies with big news that affects their number of shares outstanding, such as stock splits, announce the events in press releases that are reported by the business media. Simply using the number of shares outstanding at the end of the reporting period might give a distorted picture of the company.

- However, companies’ outstanding shares can change over time as a result of newly issued shares, repurchased shares, exercised employee stock options, or several other reasons.

- If it’s not filled in, please enter the title of the calculator as listed at the top of the page.

- Outstanding shares can also be used to calculate some key financial metrics, including a company’s market cap and its earnings per share.

- One method is for the investor to calculate a weighted average of the share price paid for the shares.

- This is the number of shares outstanding after the beginning and all entered stock transactions have been accounted for.

- A Data Record is a set of calculator entries that are stored in your web browser’s Local Storage.

How Dividends Affect Stock Prices

Stock splits are usually undertaken to bring the share price of a company within the buying range of retail investors; the increase in the number of outstanding shares also improves liquidity. In addition to listing outstanding shares or capital stock on the company’s balance sheet, publicly traded companies are obligated to report the number issued along with their outstanding shares. These figures are generally packaged within the investor relations sections of their websites, or on local stock exchange websites.

Note that this method does not account for shares that can be potentially released through various mechanisms, so a weighted average shares outstanding will not tell you the diluted EPS. The number of shares outstanding in a company will often change due to a company issuing new shares, repurchasing shares, and retiring existing shares. The number of outstanding shares can also change if other financial instruments are turned into shares. An example of this is when employees of the company convert their employee stock options (ESO) into shares.

Weighted average shares outstanding is the number of company shares after incorporating changes in the shares during the year. E.g., buyback of shares, the new issue of shares, share dividend, stock split, conversion of warrants, etc. Thus, while calculating Earnings per Share, the Company needs to find the weighted average number of shares outstanding. It incorporates all such scenarios of changes in the weighted average number of shares to give fair Earnings per share value. The number of outstanding shares changes periodically as the company issues new shares or repurchases existing shares, splits its stock or reverse-splits it.

If you would like to save the current entries to the secure online database, tap or click on the Data tab, select “New Data Record”, give the data record a name, then tap or click the Save button. Plus, after calculating the weighted average, the calculator will generate a line-by-line summary of each transaction. However, the value of each individual share is inversely related to the number of shares outstanding. This relationship makes understanding the dynamics of shares outstanding crucial for investors and industry analysts. Specifically, the number of actual shares outstanding must be altered to what it would have been if the split or dividend had occurred at the year’s start. This adjustment is made if the split or dividend occurs during the year or even after the year-end.

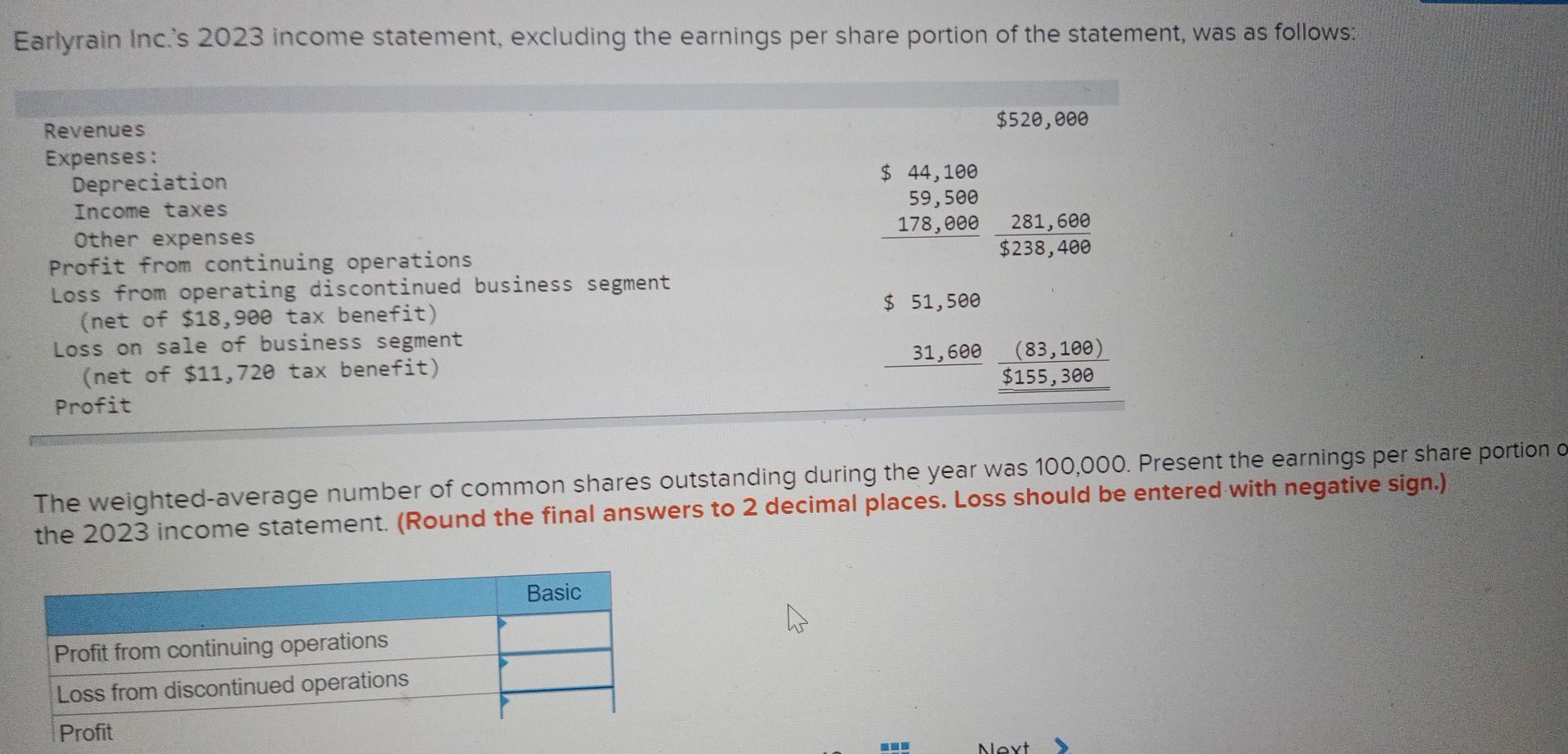

The weighted average of outstanding shares is a calculation that incorporates any changes in the amount of outstanding shares over a reporting period. It is an important number, as it is used to calculate key financial measures, such as earnings per share (EPS) for the time period. It also includes shares held by the general public and restricted shares that are owned by company officers and insiders.

Investing in the stock market or analyzing corporate finance requires a comprehensive grasp of various metrics and calculations. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Thus, the situation during the year was equivalent to having 111,000 shares outstanding throughout the year. Consequently, the generally accepted accounting principles (GAAP) require the use of an average number of shares outstanding as the starting point for all denominators.

These shares are held in the corporation’s “treasury” rather than in circulation and are therefore excluded from the number of outstanding shares. Public companies are required to report their number of shares outstanding in their quarterly and annual disclosures to the Securities & Exchange Commission. Enter each stock transaction that occurred between the beginning and end dates selected at the top of the calculator — in chronological order. Note that you can edit or delete each entered transaction by selecting it from the list and clicking either the “Save Changes” or “Delete” button.