Now that we have closed the temporary accounts, let’s review what the post-closing ledger (T-accounts) looks like for Printing Plus. Temporary (nominal) accounts are accounts that are closed at the end of each accounting period, and include income statement, dividends, and income summary accounts. These accounts are temporary because they keep their balances during the current accounting period and are set back to zero when the period ends. Revenue and expense accounts are closed to Income Summary, and Income Summary and Dividends are closed to the permanent account, Retained Earnings. It is permanent because it is not closed at the end of each accounting period.

Step 2: Close Expense accounts

- This balance is then transferred to the RetainedEarnings account.

- After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

- Stockholders’ equity accounts will alsomaintain their balances.

- The closing entry will credit Dividends and debit Retained Earnings.

The retained earnings account balance has now increased to 8,000, and forms part of the trial balance after the closing journal entries have been made. This trial balance gives the opening balances for the next accounting period, and contains only balance sheet accounts including the new balance on the retained earnings account as shown below. In short, we can clear all temporary accounts to retained earnings with a single closing entry.

Do you already work with a financial advisor?

He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

Step 4: Close withdrawals to the capital account

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

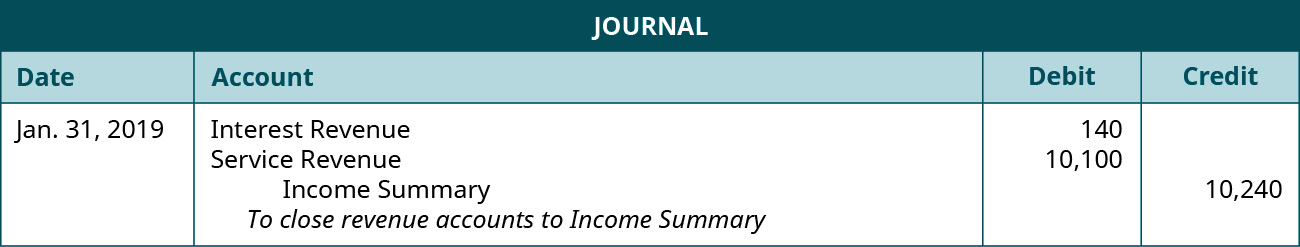

How to close revenue accounts?

It’s not reported on any financial statements because it’s only used during the closing process and the account balance is zero at the end of the closing process. The net income (NI) is moved into retained earnings on the balance sheet as part of the closing entry process. The assumption is that all income from the company in one year is held for future use. One such expense that’s determined at the end of the year is dividends. The last closing entry reduces the amount retained by the amount paid out to investors. Temporary accounts are used to record accounting activity during a specific period.

Step #1: Close Revenue Accounts

This means you are preparing allsteps in the accounting cycle by hand. In this chapter, we complete the final steps (steps 8 and 9) ofthe accounting cycle, the closing process. You will notice that wedo not cover step 10, reversing entries. This is an optional stepin the accounting cycle that you will learn about in futurecourses. how to reduce the bullwhip effect Steps 1 through 4 were covered in Analyzing and Recording Transactions and Steps 5 through 7were covered in The Adjustment Process. Notice how only the balance in retained earnings has changed and it now matches what was reported as ending retained earnings in the statement of retained earnings and the balance sheet.

Failing to make a closing entry, or avoiding the closing process altogether, can cause a misreporting of the current period’s retained earnings. It can also create errors and financial mistakes in both the current and upcoming financial reports, of the next accounting period. However, some corporations use a temporary clearing account for dividends declared (let’s use “Dividends”). They’d record declarations by debiting Dividends Payable and crediting Dividends.

In contrast, temporary accounts capture transactions and activities for a specific period and require resetting to zero with closing entries. If dividends were not declared, closing entries would cease atthis point. If dividends are declared, to get a zero balance in theDividends account, the entry will show a credit to Dividends and adebit to Retained Earnings. As you will learn in Corporation Accounting, there are three components to thedeclaration and payment of dividends.

A net loss would decrease retained earnings so we would do the opposite in this journal entry by debiting Retained Earnings and crediting Income Summary. A net loss would decrease retained earnings so we would do the opposite in this journal entry by debiting Retained Earnings and crediting Income Summary. Closing entries transfer the balances from the temporary accounts to a permanent or real account at the end of the accounting year. A business will use closing entries in order to reset the balance of temporary accounts to zero. The remaining balance in Retained Earnings is $4,565 (Figure 5.6).

Accountants may perform the closing process monthly or annually. The closing entries are the journal entry form of the Statement of Retained Earnings. The goal is to make the posted balance of the retained earnings account match what we reported on the statement of retained earnings and start the next period with a zero balance for all temporary accounts. Closing entries are journal entries used to empty temporary accounts at the end of a reporting period and transfer their balances into permanent accounts. Temporary accounts are used to accumulate income statement activity during a reporting period. The use of closing entries resets the temporary accounts to begin accumulating new transactions in the next period.