While this may or may not be true in the short term, it’s very unlikely to remain true for longer timespans. For this reason, this analysis is more effective when evaluating short-term decisions. If the store sells $30,000 worth of merchandise monthly, the variable costs may increase to $15,000.

Identifying Fixed Costs in Cost-Volume-Profit (CVP) Analysis

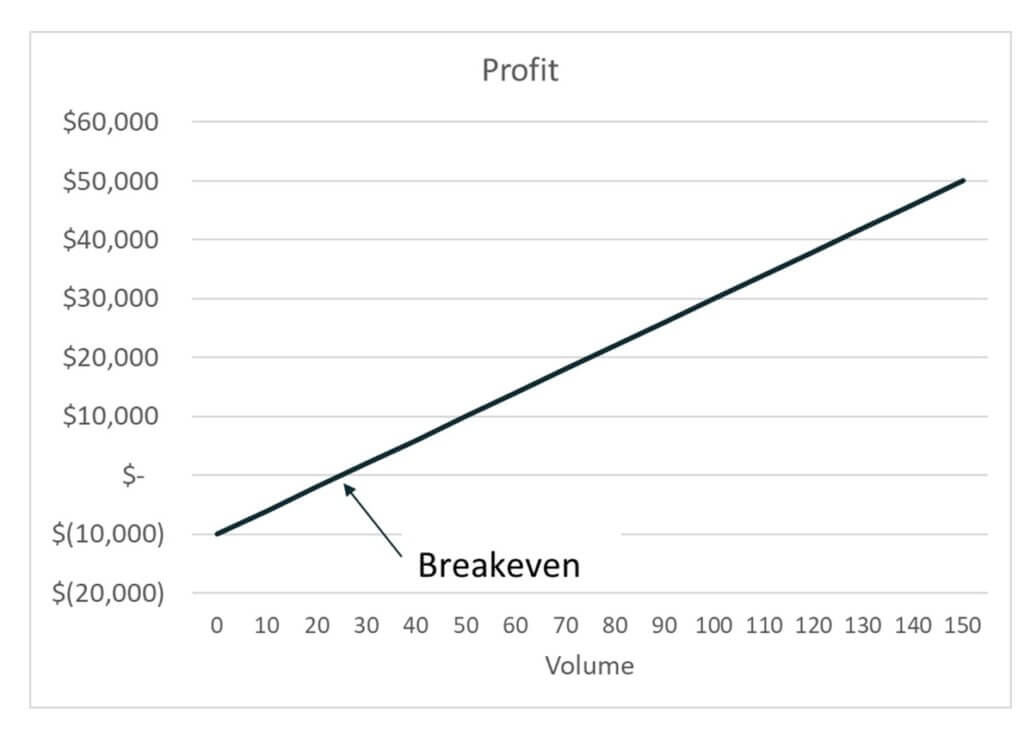

However, a major disadvantage is that the graph does not clearly reveal how costs vary with changes in activity. An advantage of the P/ V graph is that profits and losses at any point in time can be read directly from the vertical scale. An advantage of the P/V graph is that profit and losses at any point can be read directly from the vertical axis. You now know about CVP analysis and its components, as well as the assumptions and limitations of this method. You also know how to use Google Sheets to carry out your own CVP analysis.

Assumptions

- This is the point of production where sales revenue will cover production costs.

- Business operators use the calculation to determine how many product units they need to sell at a given price point to break even or to produce the first dollar of profit.

- Cost Volume Profit (CVP) Analysis is a technique used to determine the volume of activity or sales required for an organization to break even or make a profit.

- The contribution margin ratio and the variable expense ratio can help you evaluate your company’s profitability with respect to variable expenses.

- By gathering and analyzing this information, accountants can perform CVP analysis and make informed decisions about pricing, product mix, and resource allocation.

Thisremainder contributes to the coverage of fixed costs and to netincome. In Video Production’s income statement, the $ 48,000contribution margin covers the $ 40,000 fixed costs and leaves $8,000 in net income. A cost-volume-profit chart is agraph that shows the relationships among sales, costs, volume, andprofit. The illustration shows acost-volume-profit chart for Video Productions, a company thatproduces DVDs. The variable cost per DVD is$12, and the fixed costs per month are $ 40,000.

What is your current financial priority?

The decision maker could then compare the product’s sales projections to the target sales volume to see if it is worth manufacturing. Cost categories that are typically included in a CVP analysis include fixed costs, variable costs, direct materials, direct labor, and overhead expenses. These costs can be identified through an organization’s income statement or accounting records.

TOOLS

Such decisions are usually based on past estimates and market research regarding the demand for products that are offered by the business. CVP Analysis helps the business in determining how much they need to sell to break even, i.e., no profit, no loss. Cost Volume Profit Analysis includes the analysis of sales price, fixed costs, variable costs, the number of goods sold, and how it affects the profit of the business. The aim of a company is to earn a profit, and profit depends upon a large number of factors, most notable among them is the cost of manufacturing and the volume of sales. As the number of units sold increases, so does operating income when fixed costs are within their relevant range and remain the same. This is shown in the following two income statements with sales of 1,200 and 1,400 units, respectively.

One can think of contribution as “the marginal contribution of a unit to the profit”, or “contribution towards offsetting fixed costs”. The point where the total costs line crosses the total sales line represents the break-even point. This is the point of production where sales revenue will cover production costs. For our sub-business, the contribution margin ratio is ⅖, or 40 cents of each dollar contributes to fixed costs. With $20,000 fixed costs/divided by the contribution margin ratio (.4), we arrive at $50,000 in sales. Cost Volume Profit (CVP) Analysis is a technique used to determine the volume of activity or sales required for an organization to break even or make a profit.

To illustrate the concept of the break-even point in CVP analysis, let’s consider the example of a company that produces and sells widgets. The company has fixed costs of $10,000 per month, and its variable cost is $5 per widget. The break-even point is a key concept in Cost-Volume-Profit (CVP) analysis. It represents the level of sales at which a company’s total revenues are equal to its total costs, resulting in neither a profit nor a loss. To illustrate the concept of the sales price in CVP analysis, let’s consider the example of a company that produces and sells widgets. The company has a fixed cost of $10,000 per month, and its variable cost is $5 per widget.

Costs, the first component, represent the expenditures incurred by a business in its operations. Fixed costs remain constant regardless of production levels, whereas variable costs fluctuate with the production volume. In summary, the contribution margin is the amount of revenue left over after variable costs have been deducted from the sales price of a product. It is an important concept in Cost-Volume-Profit (CVP) analysis and can help businesses make informed decisions about pricing, product mix, and resource allocation.

Impractical to assume sales mix remain constant since this depends on the changing demand levels. CVP simplifies the computation of breakeven in break-even analysis, and more generally allows simple tax implications of supporting adult children computation of target income sales. It simplifies analysis of short run trade-offs in operational decisions. Cost–volume–profit (CVP), in managerial economics, is a form of cost accounting.