An IT service contract is typically employee cost intensive and requires an estimate of at least 120 days of employee costs before a payment will be received for the costs incurred. When starting a new business, this analysis can help you find out if your business idea is financially viable before you invest too much time or money. For example, If your startup costs are $50,000 and your product sells for $50 with a $20 production cost, break-even analysis shows you’ll need to sell roughly 1,700 units to cover your expenses. From there, you can decide on pricing, production, and sales targets so your business can stay on the right track from the get-go.

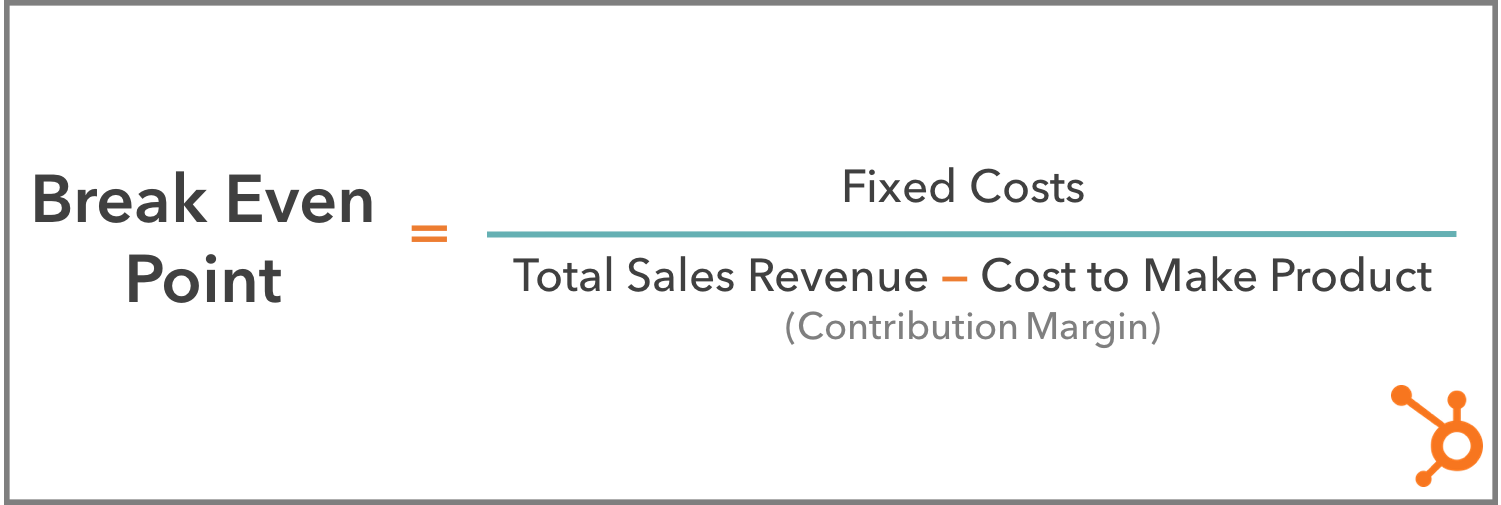

Formula For Break-Even Point

It is possible to calculate the break-even point for an entire organization or for the specific projects, initiatives, or activities that an organization undertakes. Andy Smith is a Certified Financial Planner (CFP®), licensed realtor and educator with over 35 years of diverse financial management experience. He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

Benefits of a break-even analysis

Typically, this analysis works best for businesses that focus on a single product or service. The analysis becomes more complex and less accurate if you offer a wide range of products with different price points and variable costs. For example, If you sell both high-end electronics and low-cost accessories, a single break-even analysis won’t account for the differing profit margins. You’d need individual analyses for each product category to get a more accurate picture of your profitability.

Which of these is most important for your financial advisor to have?

- $30 is the break-even price for the firm to manufacture 10,000 widgets.

- The break-even point for Hicks Manufacturing at a sales volume of $22,500 (225 units) is shown graphically in Figure 3.5.

- The break-even point is a major inflection point in every business and sales organization.

- Traders also use break-even prices to understand where a securities price must go to make a trade profitable after costs, fees, and taxes have been taken into account.

- Total revenue, on the other hand, refers to the money a company earns by selling its goods or services.

Now suppose that ABC becomes ambitious and is interested in making 10,000 such widgets. To do so, it will have to scale operations and make significant capital investments in factories and labor. The firm invests $200,000 in fixed costs, including building a factory and buying machines for manufacturing. However, the operations management insight blog a product or service’s comparably low price may create the perception that the product or service may not be as valuable, which could become an obstacle to raising prices later on. In the event that others engage in a price war, pricing at break-even would not be enough to help gain market control.

In other words, they will not begin to show a profit until they sell the 226th unit. This equation looks similar to the previous BEP analysis formula, but it has one key difference. Instead of dividing the fixed costs by the profit gained from each sale, it uses the percentage of how much value you’re getting from each unit. The break-even point is equal to the total fixed costs divided by the difference between the unit price and variable costs.

Take each bond’s yield to maturity, add one to the yield, and then use an exponential calculation, raising the sum to the power of the number of years before maturity. A final rearrangement results in Formula 5.8, which expresses the break-even point in terms of total revenue dollars. Arm your business with the tools you need to boost your income with our interactive profit margin calculator and guide. Request a demo of Zendesk Sell today to easily calculate vital sales formulas, set KPIs, and keep your sales team on track to hit ambitious, achievable goals. There are a few ways to calculate your BEP, but if you have a strong CRM like Zendesk Sell, it can calculate the values for you. You can then generate BEP reports and share them across your company to encourage different departments to implement actionable changes.

Since we earlier determined $24,000 after-tax equals $40,000 before-tax if the tax rate is 40%, we simply use the break-even at a desired profit formula to determine the target sales. There is also a category of costs that falls in between, known as semi-variable costs (also known as semi-fixed costs or mixed costs). These are costs composed of a mixture of both fixed and variable components. Costs are fixed for a set level of production or consumption and become variable after this production level is exceeded.

Some expenses will increase as sales increase, whereas some expenses will not change as sales increase or decrease. As you can see, the \(\$38,400\) in revenue will not only cover the \(\$14,000\) in fixed costs, but will supply Marshall & Hirito with the \(\$10,000\) in profit (net income) they desire. In order to find their break-even point, we will use the contribution margin for the Blue Jay and determine how many contribution margins we need in order to cover the fixed expenses, as shown below. In effect, the insights derived from performing break-even analysis enables a company’s management team to set more concrete sales goals since a specific number to target was determined. Our break-even calculator is a useful tool to refer to when determining prices for the goods and services you offer, deciding on budgets or simply working on a business plan.