Comprehensive risk evaluation is crucial for effective capital budgeting decisions. The precision of cash flow projections is vital for reliable capital budgeting analysis. This includes analyzing market risks, operational risks, financial risks, and regulatory risks. Teams use sensitivity analysis and scenario planning to understand how different risk factors might impact project outcomes.

Assessment of investment risk levels

Also, DCF tells the intrinsic value of an investment, which reflects the necessary assumptions and characteristics of the investment. The project seems attractive because its net present value (NPV) is positive. To find the overall present value, the following calculations take place using the Present Value of \(\$1\) table. To find the overall present value, the following calculations take place using the present value of \(\$1\) table.

Understanding DCF Analysis

Another advantage of the DCF model is that it can be adjusted to each investor’s expectations. The DCF model is also often seen as the most useful indicator of a company’s objective value. By estimating the intrinsic value of the company being acquired, and then comparing it to the price being paid, investors can get a better sense of whether or not an acquisition is a good deal. The model can be used to value a company as a whole, or it can be used to value specific assets such as patents or real estate. This present value can then be compared to the current market price of the stock in order to determine whether it is under- or overvalued.

- In particular, reduce this figure of future cash flow, to bring it in line with what that amount of future money could be said to be worth today.

- Note that in theory the above three approaches should deliver an identical valuation result thus the choice of what method to use is simply down to the level of information at hand and personal preference.

- A future cash flow might be negative if additional investment is required for that period.

- Teams project future cash flows for each potential investment, including initial outlay, operational cash flows, and terminal value.

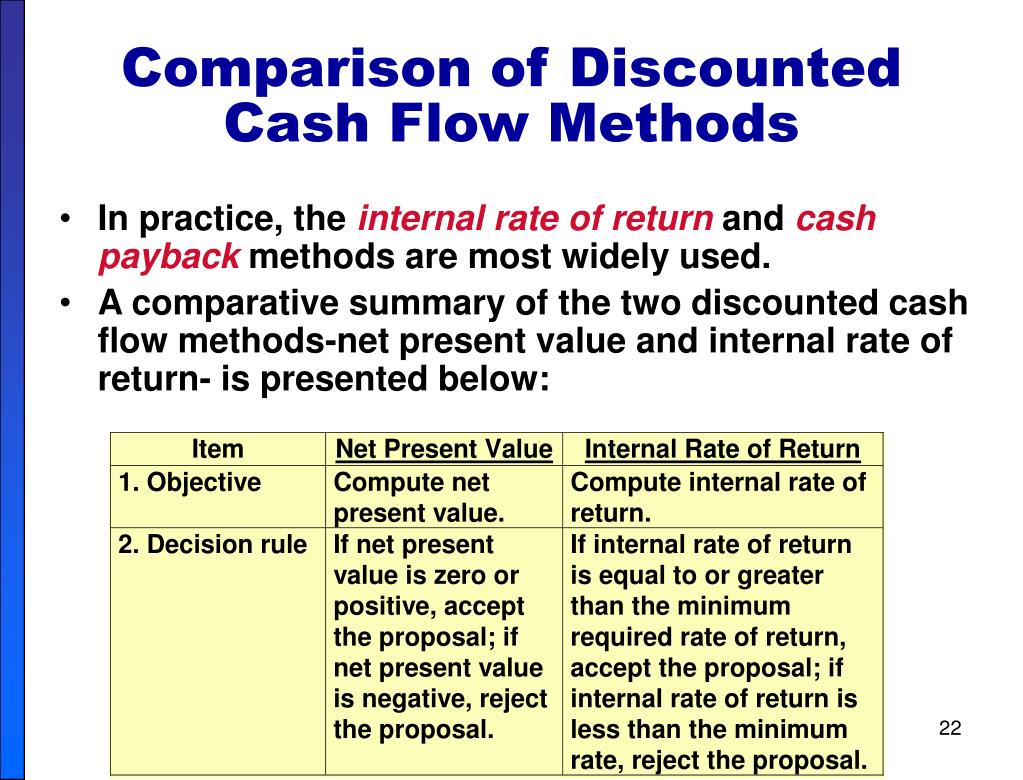

Final Summary of the Discounted Cash Flow Models

The profitability index is found by taking the present value of the net cash flows and dividing by the initial investment cost. You have a discount rate of 10% and an investment opportunity that would produce $100 per year for the following three years. Your goal is to calculate the value today—the present value—of this stream of future cash flows. Since money in the future is worth less than money today, you reduce the present value of each of these cash flows by your 10% discount rate. Specifically, the first year’s cash flow is worth $90.91 today, the second year’s cash flow is worth $82.64 today, and the third year’s cash flow is worth $75.13 today. Adding up these three cash flows, you conclude that the DCF of the investment is $248.68.

How Do You Calculate DCF?

CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path. Based on this outcome, the company would invest in Option A, the project with a higher profitability potential of \(1.157\). Yes, capital budgeting techniques are universal and can be adapted to any industry, though specific metrics and considerations may vary by sector. Volopay’s real-time visibility feature allows businesses to instantly monitor spending patterns and track budget usage across various departments and projects.

Understanding the Components of the DCF Formula

Under this method, the entire company is considered as a single profit-generating system. Throughput is measured as the amount of material passing through that system. In any project decision, there is an opportunity cost, meaning the return that the company would have received had it pursued a different project instead. In other words, the cash inflows or revenue from the project need to be enough to account for the costs, both initial and ongoing, but also to exceed any opportunity costs. These cash flows, except for the initial outflow, are discounted back to the present date.

Organizations should consistently apply appropriate discount rates and consider inflation, opportunity costs, and risk factors when evaluating future cash flows. Sensitivity analysis is a risk assessment technique that evaluates how changes in key variables affect project outcomes. It helps identify which factors have the most significant impact on project success by examining how variations in inputs like costs, revenues, or discount rates influence financial metrics. Real options analysis is one of the advanced methods of capital budgeting that evaluates flexibility in investment decisions. It considers management’s ability to modify projects as new information becomes available, including options to expand, delay, or abandon projects in response to changing market conditions.

Understanding the time value of money helps organizations optimize their capital allocation by identifying investments that generate the most value over time. Changes in discount rates can significantly affect project valuations and rankings, making their selection crucial for accurate financial analysis. tax form 1099 The assessment should consider both systematic and unsystematic risks, incorporating appropriate risk premiums into discount rates and adjusting cash flow projections to reflect potential variations. Provides a comprehensive view of project risk by considering multiple variables simultaneously.

With Volopay’s accounts payable software, you can automate vendor payments and invoice processing, reducing manual intervention and processing time. The automated data flow helps maintain consistency across different financial systems and improves reporting accuracy. The software automatically captures and categorizes expenses, eliminating manual data entry and reducing processing time. Automation streamlines the approval process by creating digital workflows that route proposals to appropriate decision-makers efficiently. This integration provides a comprehensive view of financial information, enabling more thorough analysis.

It examines multiple variables simultaneously under different scenarios (typically best-case, worst-case, and most likely) to understand potential project performance under various market conditions. Payback period offers a simple, easily understood measure of investment risk and liquidity. It helps evaluate how quickly capital can be recovered, which is particularly valuable for businesses operating in volatile markets or with limited resources. Methods of capital budgeting enable businesses to distribute their financial resources efficiently across various investment opportunities. Scanning the Present Value of an Ordinary Annuity table reveals that the interest rate where the present value factor is 5 and the number of periods is 7 is between 8 and 10%. Since the required rate of return was 7%, Rayford would consider investment in this metal press machine.

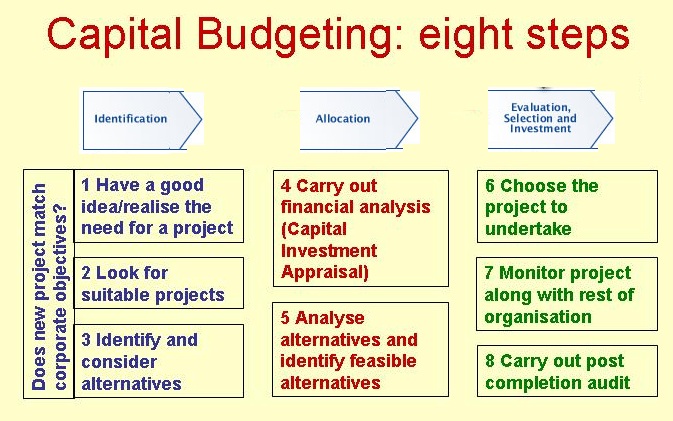

Government policies, regulations, and compliance requirements play a crucial role in shaping capital budgeting decisions. This involves resource allocation, team formation, timeline development, and establishment of project management protocols to ensure the smooth execution of the investment plan. Techniques of capital budgeting provide a quantitative foundation for financial planning decisions. This systematic evaluation ensures that limited resources are directed toward opportunities that offer the best combination of profitability and strategic alignment.